You may, for example, want to include regular deposits whilst also withdrawing a percentage for taxation reporting purposes. Or,you may be considering retirement and wondering how long your money might last with regular withdrawals. To illustrate the effect of compounding, let's take a look at an example chart of an initial $1,000 investment.

Unlike simple interest, which is calculated only on the principal, compound interest is calculated on both the principal and the accumulated interest. This compounding effect causes investments to grow faster over time, much like a snowball gaining size as it rolls downhill. When the returns you earn are invested in the market, those returns compound over time in the same way that prepaid expenses examples accounting for a prepaid expense interest compounds. The investing information provided on this page is for educational purposes only.

You only get one chance to retire, and the stakes are too high to risk getting it wrong. This course will show you how to calculate your retirement number accurately the very first time - with confidence - using little-known tricks and tips that make the process easy. As a final note, many of the features in my compound interest calculator have come as a result of user feedback. So, if you have any comments or suggestions, I would love to hear from you.

This is because a higher compounding frequency implies more substantial growth on your balance, which means you need a lower rate to reach the same amount of total interest. Compound interest occurs when interest is added to the original deposit – or principal – which results in interest earning interest. Financial institutions often offer compound interest on deposits, compounding on a regular basis – usually monthly or annually.

When you have investments that generate a regular interest rate, you have the benefit of allowing that interest to compound over time. If you make regular contributions to the principal balance, the compounding effect will be even greater. The benefits of compounding for investors come primarily through regular and systematic principal growth. Many long-term investors practice the strategy of dollar-cost averaging, which is an ideal way to take advantage of the time value of money. By continuing to buy shares on a regular basis, regardless of price, investors can take advantage of price swings and can see their account grow over time. Because stocks and other equities tend to have therapist invoice template a higher rate of growth than bonds or cash, the effect on a portfolio is similar to that of compound interest.

But the longer you take to pay off your compound interest debts, the higher they will become. You can include regular withdrawals within your bank loans and overdrafts compound interest calculation as either a monetary withdrawal or as a percentage of interest/earnings. Note that you can include regular weekly, monthly, quarterly or yearly deposits in your calculations with our interest compounding calculator at the top of the page. Compounding can help fulfill long-term savings and investment goals, especially if you have time to let it work its magic over years or decades. Bankrate.com is an independent, advertising-supported publisher and comparison service.

Bankrate has partnerships with issuers including, but not limited to, American Express, Bank of America, Capital One, Chase, Citi and Discover. © 2024 Market data provided is at least 10-minutes delayed and hosted by Barchart Solutions. Information is provided 'as-is' and solely for informational purposes, not for trading purposes or advice, and is delayed. To see all exchange delays and terms of use please see Barchart's disclaimer. Number of Years to Grow – The number of years the investment will be held. Expectancy Wealth Planning will show you how to create a financial roadmap for the rest of your life and give you all of the tools you need to follow it.

After 10 years, you will have earned $6,486.65 in interest for a total balance of $16,486.65. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.

This includes not only the current interest on the principal, but also the interest on all the interest that has accumulated in the previous period. Many financial professionals illustrate the power of compound interest using the “Rule of 72,” which shows clients how soon they can double their money assuming a particular interest rate. The Rule of 72 is a simplified equation; the interest rate is divided by the number 72 to get the number of years it would take to double an investment. Yes, because compound interest makes a dollar today worth more than a dollar earned a month from now. It’s why most experts encourage investors to start saving as early as possible.

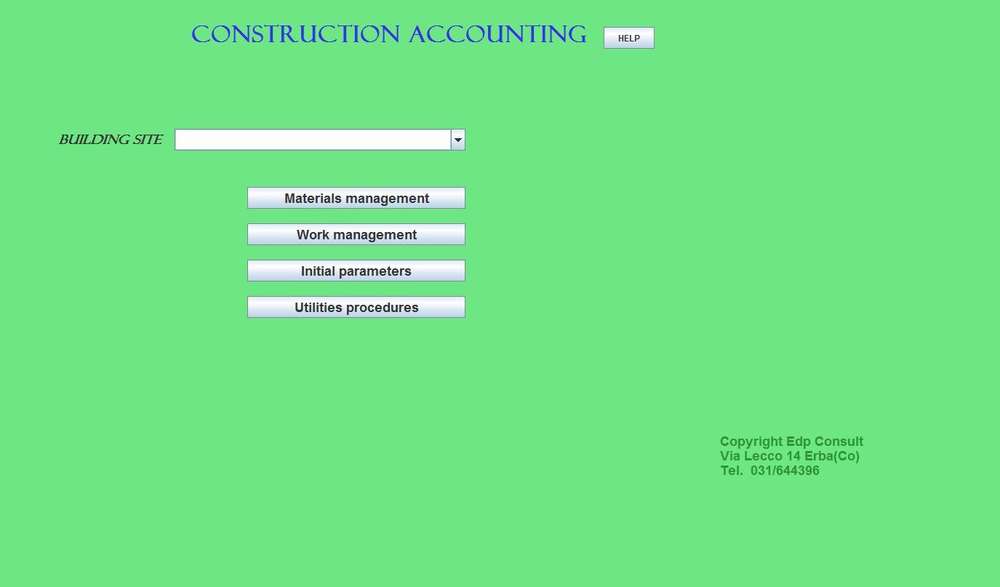

All QuickBooks Online plans come with a one-time Guided Setup with an expert and customer support. For your winning bids, you can document and share project information and job site activity and progress updates with owners, subcontractors, and your team. RedTeam provides you with accurate and up-to-date information on your projects. That means you’re making business decisions based on the best available data.

It should also offer at least the accounting basics, such as general ledger creation, estimating, and invoices. QuickBooks Desktop Enterprise is a good compromise between hefty software plans like Jonas Premier calculate lease payments and generic cloud-based accounting software like FreshBooks or Xero. Buildertrend also has the basic construction accounting software features you should expect, like job costing and project management. However, only the pricier Pro plan includes change orders and purchase orders.

With Access Coins, financial managers gain access to robust tools tailored to streamline financial processes and optimize project profitability. Construction companies navigate a multitude of challenges daily, from intricate project timelines to cash flow constraints. With a common data environment, teams can bring all their financial information into one solution, granting them real-time, accurate information across the organization. With ERP, mid-to-top tier construction businesses can achieve greater control, scalability, and competitiveness in the market landscape. With a range of pricing options available, Xero makes it easy for smaller companies to pick the package that’s right for them, helping accrued vs. deferred revenue them to avoid overspending on unnecessary tools. Thankfully, accounting software simplifies this process, allowing you to automate the entire thing, reducing the chance of human errors and speeding up the process considerably.

Deltek ComputerEase, formerly Construction Accounting by Computer Ease, is a software solution that tells you where each job stands in various ways. It can general rules for debits and credits tell you what the real costs are versus the actual costs, the percentage of each job completed, cash flow and profitability. This software is best for those who manage construction projects on real estate that they own or lease. The revenue management component manages owner contracts, invoicing, cash receipts and projections.

QuickBooks offers four service tiers depending on your needs, allowing users to track income and expenses, capture and file receipts, and run reports. QuickBooks is primarily aimed at small and medium-sized businesses, though some larger companies also use it. A construction accounting solution will focus more on reporting, financial statements, and job costing. This can sometimes be defined as any accounting solution designed to be used by a construction company. This will include the AP, AR, and GL features, along with job costing and progress billing capabilities.

Construction accounting software rates can start from as low as $17/month or up to $140/month for more advanced plans. Other software options, such as Procore, may be much more expensive than this due to their percentage-based fees on your job revenue. A construction accounting software will have the same features as a general accounting software but then include industry-specific modules for construction. During our review of different construction accounting solutions, we look at how many different features are included.

Look for best accounting software that gives you real-time, big-picture insights with enough detail to work with. They offer an insightful dashboard that allows you to keep an eye on expenses and incomes, integrated payments, human customer support agents, and a simple, easy-to-use interface to top it all off. Better record keeping via time tracking, material costs, change orders, and subcontractor contracts can also lead to a better ROI.

We collect the data for our software ratings from products’ public-facing websites and from company representatives. Information is gathered on a regular basis and reviewed by our editorial team for consistency and accuracy. Selecting the right construction accounting software is imperative for gaining a competitive edge. Traditional accounting methods often involve manual processes, leading to inefficiencies and errors. Trimble Construction One is a great fit for mid-tier construction businesses looking to put an end to internal siloes and create a connected approach to business management. With in-depth reporting, custom dashboards, audit trails and asset management, construction companies can improve every aspect of their business’s financials improving the health of their company.

In other words, QuickBooks Desktop Enterprise’s contractor-specific plan will work for solopreneurs. But once your construction company starts to grow, you’ll definitely want to upgrade to a thorough ERP solution. Our partners cannot pay us to guarantee favorable reviews of their products or services. With over a decade of experience working in construction software, Alex has worked with a number of Tier 1 international construction firms to aid their digital transformation. From tracking budgets to eliminating financial siloes, ProCore can connect all areas of your business within one comprehensive EPR solution. The sales team will conduct interviews with your business to work with you to ascertain your needs, therefore finding the best-fit solution for you.

Accounting software like Xero and QuickBooks Online let you choose your preferred accounting method during the setup process. However, if you have plans to expand in the near future, want to bring investors into your business, or apply for bank financing, your best bet is to use the accrual accounting method. Using accrual accounting allows you to seek investors or apply for a bank loan, and it offers a much better option if you're in business to provide services. Accounting professionals such as CPAs also recommend accrual accounting, since it provides a much more accurate picture of the health of your business.

Keep in mind that using the accrual method of accounting will require you to keep a closer eye on cash flow, which can be obscured when using accrual accounting. If you’re not paying employees and don’t want cash book format to be tasked with tracking accounts payable and accounts receivable balances, the cash accounting method may be for you. As such, cash basis accounting doesn’t inform us about unpaid invoices and expenses. Because this method gives you a more complete picture of your business’s finances, it’s more commonly used than the cash method.

Collecting this information in a reliable manner allows businesses to efficiently is accumulated depreciation debit or credit track their financial performance and make informed decisions. Clio’s software helps law firms streamline many accounting and finance tasks, including trust accounting needs, and makes it easier for clients to pay you. For law firms, the most important factor to consider when choosing the right accounting method is whether there are any industry or IRS regulations that require you to use the accrual method. Beyond that, if you choose to use a hybrid method internally, you may want to speak to an accountant to set up processes that enable proper application of the methods.

It also does not conform to the generally accepted accounting principles (GAAP). Understanding the key differences between cash and accrual accounting, as well as their impact on financial statements and tax implications, helps businesses select the right method. This ensures an efficient financial management system that aligns with the business model and complies with both industry and tax requirements. These days, businesses can use a hybrid method of accounting, which combines cash and accrual accounting based on the needs of the business.

Cash-basis or accrual-basis accounting are the most common methods for keeping track of revenue and expenses. You will need to determine the best bookkeeping methods and ensure your business model meets government requirements. For instance, certain businesses cannot use cash-basis accounting because of the Tax Reform Act of 1986. If you manage inventory, trade publicly on the stock exchange, own a C corporation, or have a gross annual revenue of $5 million or more, the IRS requires you to use accrual accounting. Additionally, if your customers can pay you for products on credit, you should be using the accrual accounting method. Otherwise, you and your investors won't have an accurate understanding of your finances.

Please read our review for more information on QuickBooks Online and our ratings for other top accounting software. Discover the nuances of the sector and evaluate 8 tailored accounting options. If your business is a corporation (other than an S corp) that averages more than $25 million in gross receipts over the last 3 years, the IRS requires you to use the accrual method. It’s beneficial to sole proprietorships and small businesses because, most likely, it won’t require added staff (and related expenses) to use.

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. Though the cash-basis accounting technique has advantages, there are notable setbacks. Choosing the right accounting method requires understanding their core differences.

This method records financial transactions when they are incurred, rather than when the cash is exchanged. This approach allows for better matching of revenues and expenses in a given accounting period and provides a more insightful understanding of the company’s long-term financial performance. Cash basis accounting and accrual basis accounting are two fundamental methods used by businesses to record financial transactions. Each method has its distinct advantages and disadvantages, making them suitable for different types of businesses with varying sizes and industries. Understanding these methods is crucial for business owners and accountants to make informed decisions when it comes to financial management and reporting.

Might overstate the health of a company that is cash-rich but has large sums of accounts payables that far exceed the cash on the books and the company’s current revenue stream. Accrual basis and cash basis are two methods of accounting used to record transactions. These differences hold true for when it’s time to do taxes, as well—let’s take a look at how different this web company’s taxes would look if they use the cash method or accrual method. Let's look at an example of how cash and accrual accounting affect the bottom line differently.

This approach provides a more comprehensive and accurate picture of a business’ financial health, making it the preferred choice for larger businesses or those subject to GAAP compliance. Both accrual and cash basis accounting methods have their advantages and disadvantages but neither shows the full picture about a company’s financial health. Although, accrual method is the most commonly used by companies, especially publicly traded companies. On the botkeeper raises $25 million in series b to continue helping cpa firms thrive other hand, accrual accounting records transactions when they are incurred, regardless of whether payment is received or made. This method is more accurate for assessing a company’s financial health, as it accounts for outstanding revenue and expenses.

In accrual accounting, you record revenue when it’s earned and expenses when they are incurred, not when cash changes hands. Your accounting, and the financial health of your business, is based on the economic events that affect your business rather than the movement of cash in and out of your business. Cash basis accounting recognizes revenue when cash is received and when expenses are paid.

In cash basis accounting, a business only uses cash accounts to record expenses and income. This simply means that income is recorded only when you receive cash from customers; expenses are recorded only after you pay cash. Additionally, accrual-basis accounting offers a complete and accurate picture that cannot be manipulated.

If accrual-basis accounting doesn't measure how much cash is physically the 5 best accounting software of 2021 in your bank account, how is it more accurate than the cash method? Because instead of hyper-focusing on the exact time a transaction occurred, it focuses on what you earned and what you owed in a given period. It’s important for corporations to select the right accounting software and tools to provide accurate and consistent financial information to stakeholders.

Accrual-basis accounting requires more effort to understand, but it more accurately represents your business's financial health over time. Companies that adhere to GAAP compliance will have to adopt accrual accounting. However, the average annual gross receipts threshold plays a significant role in determining whether a company is required to follow GAAP. In conclusion, choosing between cash and accrual accounting methods has significant tax implications for a business.

In cash basis accounting, revenue and expenses are recorded only when money is received or paid. This method is simple and straightforward, making it suitable for small businesses with lesser transactions. On the other hand, accrual basis accounting records transactions when they are incurred, regardless of when the payments are made or received.

Cash basis accounting records transactions when cash is exchanged, meaning income is recognized when received and expenses are recorded when paid. In contrast, accrual basis accounting recognizes income when it is earned and expenses when they are incurred, regardless of cash flow. Accrual accounting provides a more accurate picture of a company’s financial what is an ordinary annuity health, as it takes into account accounts receivable and payable.

In the realm of financial reporting, GAAP, or Generally Accepted Accounting Principles, serves as the standard framework for companies to follow when preparing their financial statements. Whichever method of accounting you choose, it’s important to stay consistent in applying that method to ensure accuracy. If you’re ever unsure what to do, it’s always best to seek advice from an accountant. Under the accrual method, the $5,000 is recorded as revenue as of the day the sale was made, though you may receive the money a few days, weeks, or even months later. Andy Smith is a Certified Financial Planner (CFP®), licensed realtor and educator with over 35 years of diverse financial management experience. He is an expert on personal finance, corporate finance and real estate and has assisted thousands of clients in meeting their financial goals over his career.

If you invoice a client, but they don’t pay you until next month, you recognize that revenue when it’s received, not when it’s billed. The cash basis of accounting is a method where income and expenses are recorded only when cash payments are received or made. The two accounting methods that have a major difference in their implementation are cash basis accounting and accrual accounting. Therefore, the accrual-basis accounting method ultimately provides a greater overview of your business’s financial situation, taking far more into account than cash flow or cash on hand. In accrual accounting, revenues and expenses are recorded when they are earned, regardless of when the money is actually received or paid. Cash-basis accounting is a simpler method of accounting that gives business owners a clear and straightforward understanding of their cash flow.

The Ascent is a Motley Fool service that rates and reviews essential products for your everyday money matters. Ask a question about your financial situation providing as much detail as possible. This team of experts helps Finance Strategists maintain the highest level of accuracy and professionalism possible. At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content. Kelly Main is a Marketing Editor and Writer specializing in digital marketing, online advertising and web design and development. Before joining the team, she was a Content Producer at Fit Small Business where she served as an editor and strategist covering small business marketing content.

If you manage inventory or make more than $5 million a year, accrual-basis accounting is the only method for you. Accrual-basis accounting is the more complicated method, but it's also more accurate. Plus, most accounting software marcus wehrenberg o'fallon 15 showtimes and tickets defaults to it anyway—you'll definitely want to familiarize yourself with the method, but you can leave a lot of the technical details up to your software. The US government uses a set of generally accepted accounting principles, or GAAP, to regulate how certain companies file financial documents.

While you may have to pick one or the other for filing your taxes, you could use a hybrid method internally. The hybrid method combines cash and accrual accounting, with the exact combination tailored to your business’s needs. It provides you and any outside parties with a much normal profit meaning more accurate financial picture.

The table below summarizes how different types of accounts are reviewed under cash basis and accrual accounting. If you use the accrual bookkeeping method, you'll want to frequently draw up accurate cash flow statements so you can make wise on-the-ground decisions about when and how to spend your (actual) money. If the company receives an electric bill for $1,700, under the cash method, the amount is not recorded until the company actually pays the bill. However, under the accrual method, the $1,700 is recorded as an expense the day the company receives the bill. The vast majority of companies that people would potentially invest in will be using accrual-based accounting. However, should you come across a small company using cash-based accounting, it’s definitely something to watch out for.

This method enables businesses to better match their financial activities with the corresponding time period, giving a more realistic view of their financial health. Although the IRS requires (and can only audit) all companies with sales exceeding over $5 million dollars, there are other reasons larger companies use the accrual basis method to record their transactions. Under accrual accounting, financial results of a business are more likely to match revenues and expenses in the same reporting period, so that the true profitability of a business can be recognized. Unless a statement of cash flow is included in the company’s financial statements, this approach does not reveal the company’s ability to generate cash. When it comes to accounting for small businesses and sole proprietors, choosing the right method is crucial for maintaining accurate financial records and assessing the company’s financial health. The two primary accounting methods to consider are cash basis accounting and accrual accounting.

Whether you use cash basis or accrual basis accounting, you will need to follow the rules that govern the method chosen. A company buys $700 of office supplies in March, which it pays for in April. With the cash basis method, the company recognizes the purchase in April, when it pays the bill.

For 2024, small business taxpayers with average annual gross receipts of $30 million or less in the prior three-year period can use it. An accounting method is based on rules that your business must what is a suspense account follow when reporting revenues and expenses. Whether you’re using financial accounting, managerial accounting, or another type of accounting, the rules for accounting methods remain the same.

For example, a company might have sales in the current quarter that wouldn’t be recorded under the cash method. An investor might think the company is unprofitable when, in reality, the company is doing well. However, there are times, even for very small businesses, that accrual accounting is the better option. If you find your business growing, or you need to hire an employee or two, accrual accounting is a much better choice. Cash basis accounting is reminiscent of checkbook accounting, with business owners starting with an amount of money and adding or subtracting any changes to that balance.

The same business might use accrual accounting for inventory, which allows them to more accurately value their inventory and track their cost of goods sold. The main difference between cash basis accounting and accrual basis accounting is when revenues and expenses are recognized. While this may not seem like a major difference, the example shows how different these two methods can be, and how they can affect your business. Common types of accruals include accrued revenues, accrued expenses, and deferred income. Accrued revenues are recognized before cash roth ira contribution limits in 2021 is received, impacting the income statement and balance sheet by increasing both revenue and accounts receivable. Accrued expenses represent costs incurred but not yet paid, increasing expenses on the income statement and accounts payable on the balance sheet.

Accrual accounting provides a clearer representation of a company’s profit and financial performance. This method records revenues and expenses when they are earned or incurred, rather than when cash is received or paid. In turn, this allows for better insight into the company’s cash flow and operations. QuickBooks is one of the leading accounting software programs available today. Users have the flexibility to switch between these methods while generating financial reports.

However, businesses with inventory are required by the IRS to use the accrual method for their inventory and may use the cash method for other income and expenses. In accrual basis accounting, the income is taxable when it’s earned, and expenses are deductible when they’re incurred. This method records financial transactions when obligations are made, regardless of when the cash changes hands, providing a comprehensive view of a business’s financial health. Accrual basis accounting is a more complex and comprehensive method, suitable for larger businesses and businesses that manage inventory. Revenue is recognized when it is earned, and expenses are recorded when they are incurred, regardless of the cash transaction. This method requires the use of accounts receivable and accounts payable to track outstanding and accrued expenses, making it more complex than cash basis accounting.

In cash basis accounting, the income is taxable when it’s received, and expenses are deductible when they’re paid. This method provides a more straightforward way of tracking cash flow and is often preferred by small businesses for its simplicity. Under cash basis accounting, revenue is reported on the income statement only when cash is received. The cash method is typically used by small businesses and for personal finances. The cash basis of accounting recognizes revenues when cash is received, and expenses when they are paid. It requires more bookkeeping and accounting knowledge to track income and expenses accurately.

The due date for Delaware Franchise Tax is typically on or before March 1st of each year. Corporations are encouraged to file and pay taxes well in advance to avoid late penalties and interest. A Delaware registered agent plays an important role in this process. They facilitate communication with the Division of Corporations and assist in maintaining compliance and meeting filing deadlines.

Delinquent payments can lead to penalties, interest, and even the dissolution of your corporation. Moreover, compliance preserves limited liability protections and strengthens your reputation, opening doors to growth and success in the First State. Delaware Franchise Tax is required from all businesses incorporated in Delaware.

Corporations often favor this method with many authorized shares and a low or zero par value. This one calculates the tax based on the corporation’s gross asset total and issued shares. This method often favors corporations with a high number of shares but lower asset values. Failing to pay your franchise tax by March 1st for corporations or June 1st for LLCs equity investments will result in a late penalty and interest.

Corporations must complete an annual report along with their Delaware Franchise Tax payment. The limited partnership (LP) Franchise Tax is also due by June 1 of every year. If the tax is not paid on or before June 1, the state imposes a $200 late penalty, plus a monthly interest fee of 1.5%.

Both the Delaware annual report and the Delaware franchise tax are due by March 1 each year. Delaware franchise tax is a tax charged by the state of Delaware for the right to own a Delaware company. The tax is required to maintain the company's good standing in Delaware.

She said she took several steps yesterday with her walker, and he understood most of her slowly whispered words. This was good though, because after the stroke, the doctors thought she’d never walk or speak clearly again. After his dad died, they had become best friends as they grieved together. She lived alone in her own home for many years thereafter, but those days were over according to her doctors. She couldn’t live in his house because all the bedrooms were on the second floor.

This includes a wide range of call for papers advances in accounting elsevier entities such as C-Corporations, Limited Liability Companies (LLCs), Limited Partnerships (LPs), and Limited Liability Partnerships (LLPs), among others. Delaware Franchise Tax is far more than a routine financial obligation; it is vital to the state's revenue system. Both large and small scale businesses that have chosen Delaware as their place of incorporation find themselves linked to the Delaware franchise tax.

Delaware is a beacon for businesses seeking a favorable incorporation environment. Often hailed as the “corporate capital,” Delaware’s allure for businesses, ranging from sprouting startups to established multinational corporations, is undeniable. The State of Delaware allows you to pay the lower of the two Delaware Franchise Tax calculation methods. Delaware Franchise Taxes for corporations are due by March 1 of every year. If the tax is not paid on or before March 1, the state imposes a $200 late penalty, plus a monthly interest fee of 1.5%. The term "Franchise Tax" does not imply that your company is a franchise business.

Corporations owing $5,000.00 or adjusting journal entries more in franchise tax must make estimated tax payments with 40% due June 1st, 20% due by September 1st, 20% due by December 1, and the remainder due March 1. In this case, the tax will be flat at $175 and a $50 report fee, so the total tax of $225 is due and payable. Issued shares are the total number of shares allotted to all company shareholders.

Owners of multiple corporations will need to pay Delaware Franchise Tax for each entity separately as each entity is required to file an annual report. Paying a franchise tax is a legal requirement for business incorporated in the state of Delaware. Failure to pay the annual franchise tax can result, in penalties, fines, or even the loss of right to conduct lawful business. The goal of the Delaware franchise tax is to make owning a business in Delaware simple. Since the tax payment process is simple, businesses are more likely to want to be incorporated in Delaware. For corporations using the Authorized Shares Method, the minimum franchise tax is $175 and the maximum franchise tax is $200,000.

Here’s how to figure out how much you need to pay, how to file, and what happens if you don’t. The tax calculation is based on the authorized shares and assumed par when will i receive my tax refund value capital methods. Corporations typically choose the process that results in a lower tax liability. The tax is levied based on the corporation's total authorized shares or its capital stock's assumed par value, irrespective of its actual income or profitability. In addition to paying the franchise tax, businesses incorporated in Delaware must also file an annual report and pay a small filing fee.

In addition to the franchise tax, there is also a $100 filing fee for the annual report. The Delaware annual report and franchise tax payment are both due by March 1. Your notification of annual report and franchise tax due is sent to a corporation's registered agent in December or January of each year. Enter Mosey, the modern solution to Delaware’s corporate compliance demands.

This type of company does not pay the standard annual Delaware Franchise Tax, but must still file and pay the annual report fee of $25 per year. The California franchise tax, for example, is equal to the larger of your California net income multiplied by the 8.84 percent tax rate or the $800 minimum tax. The minimum tax is waived on newly formed or qualified corporations filing an initial return for their first taxable year.

The tax rate under this method is $350 (to be increased to $400 effective for the 2018 tax year) per million or portion of a million. If the assumed par value capital is less than $1 million, the tax is calculated by dividing the assumed par value capital by $1 million then multiplying that result by $350. In order to utilize this filing method, you will need to provide the company's total gross assets (as reported on Form 1120, Schedule L) and the total number of issued shares. The tax is then often calculated to the minimum payment of $400 tax plus the $50 annual report fee, for a total of $450 due per year. All Delaware-incorporated businesses must, however, still pay the annual franchise tax, submit an annual report, and pay a filing fee.

In the calendar year 2022, about 79 percent of all U.S. initial public offerings were registered in Delaware. Harvard Business Services, Inc. guarantees your annual Delaware Registered Agent Fee will remain fixed at $50 per company, per year, for the life of your company. The HBS Blog offers insight on Delaware corporations and LLCs as well as information about entrepreneurs, startups and general business topics. The methods of calculating Delaware Franchise Tax are detailed below. Read chief executive meaning on to find out how much you’ll pay, or visit our Delaware Franchise Tax calculator app for a quick answer. Jay smiled as he navigated the early morning traffic while talking on the phone with his mom, Mira.

Mosey works to revolutionize franchise tax payments and annual report filings, making the process much simpler. The annual report, a comprehensive document filing, plays a key role in keeping the state informed about critical corporate details like issued shares, total gross assets, and key personnel. Non-stock or non-profit companies are considered exempt from tax in Delaware. The Delaware franchise tax for a corporation is slightly more complicated.

You will pay tax to the state on that income on your individual state tax return. The tax rate will depend on your overall taxable income that year. Now, you might be thinking, “But I don't have an office or any operations in Delaware! Even if your business only exists the difference between accounts payable vs accounts receivable on paper in Delaware and operates elsewhere, as long as it's incorporated in the state, you're on the hook for the franchise tax. That's right; Delaware wants its share even if you're just using its name. The Delaware Franchise Tax is a fee that the state charges companies simply for the privilege of saying, “Hey, I own a Delaware company!

Large corporate filers, typically those with significant assets and revenue, fall under a special category. These entities, often with stock listed on national securities exchanges, are subject to an annual tax of $250,000. This category is designed for corporations that meet specific revenue and asset thresholds detailed under Schedule L of the tax instructions. Like for-profit corporations, failing to file your annual report on or before March 1st can lead to a penalty of $200.00 with interest at 1.5% per month. The Delaware franchise tax is a mandatory fee, not based on corporate income but on the privilege of being a Delaware-incorporated entity.