With FIFO in place, businesses can efficiently manage their stockpile, ensuring older products move out before they become obsolete or expire. Considering that deflation is the item's price decrease through time, you will see a smaller COGS with the LIFO method. Also, you will see a more significant remaining inventory value because the most expensive lifo and fifo calculator items were bought and kept at the very beginning.

In other words, the beginning inventory was 4,000 units for the period. In the tables below, we use the inventory of a fictitious beverage producer called ABC Bottling Company to see how the valuation methods can affect the outcome of a company’s financial analysis. FIFO uses the First in First out method where the items made or purchased first are sold out which is why it is easy and convenient to follow and implement for companies and businesses. Businesses usually sell off the oldest items left in the inventory as they might become obsolete if not sold further. So FIFO follows the same way of going with the natural flow of inventory.

Dollar-Cost averaging is the simplest method of calculating inventory value. Here, all the costs are added, and then, divided by the number of items, which gives a nice estimate of inventory value. LIFO (Last in, First out) is an accounting method that considers that inventory, raw materials, and components purchased most recently were sold first. Effective inventory management is critical for keeping your stock levels balanced, ensuring that products are available when customers need them. You can streamline this process with FIFO and LIFO calculators by systematically updating your inventory records. This logical flow mirrors natural consumption patterns and simplifies stock tracking, leading to a more accurate reflection of inventory value over time.

Accountants use “inventoriable costs” to define all expenses required to obtain inventory and prepare the items for https://www.instagram.com/bookstime_inc sale. For retailers and wholesalers, the largest inventoriable cost is the purchase cost. Suppose the number of units from the most recent purchase been lower, say 20 units. We will then have to value 20 units of ending inventory on $4 per unit (most recent purchase cost) and the remaining 3 units on the cost of the second most recent purchase (i.e., $5 per unit). Now that we have ending inventory units, we need to place a value based on the FIFO rule.

This is because this inventory method assumes that the first items to be sold in that accounting period are the most expensive to produce. FIFO has advantages and disadvantages compared to other inventory methods. FIFO often results in higher net income and higher inventory balances on the balance sheet.

You can also check FIFO and LIFO calculators at the Omni Calculator website to learn what happens in inflationary/deflationary environments. Accounting for inventory is essential—and proper inventory management helps you increase profits, leverage technology to work more productively, and to reduce the risk of error. To calculate the value of ending inventory using the FIFO periodic system, we first need to figure out how many inventory units are unsold at the end of the period. Here’s a summary of the purchases and sales from the first example, which we will use to calculate the ending inventory value using the FIFO periodic system.

In this case, the store sells 100 of the $50 units and 20 of the $54 units, and the cost of goods sold totals $6,080. Companies often use LIFO when attempting to reduce its tax liability. LIFO usually doesn't https://www.bookstime.com/ match the physical movement of inventory, as companies may be more likely to try to move older inventory first.

Calculating FIFO involves valuing inventory based on the assumption that the first items entered into inventory are the first sold. Conversely, LIFO assumes the last items to enter inventory are the first sold. Each methodology significantly impacts financial reporting and tax calculations, depending on the fluctuation of purchase costs over time. Keeping track of all incoming and outgoing inventory costs is key to accurate inventory valuation.

Since the seafood company would never leave older inventory in stock to spoil, FIFO accurately reflects the company's process of using the oldest inventory first in selling their goods. For example, a company that sells seafood products would not realistically use their newly-acquired inventory first in selling and shipping their products. In other words, the seafood company would never leave their oldest inventory sitting idle since the food could spoil, leading to losses. Using FIFO ensures that older, perishable items are sold before newer ones, minimizing waste and loss.

Get up to speed on the state of crowdfunding shipping with expert Easyship analysis and keep your campaign on budget. Use our guided walk-through to build the perfect shipping policy for your eCommerce business. Our mission is to provide useful online tools to evaluate investment and compare different saving strategies. This is particularly important if the inventory consists of sensitive components or electronics that could be damaged if left too long in storage. Perishables, like food substances, are also handled using the FIFO method. While FIFO is a wonderful method for assessing the value of your inventory, it’s not the only one you can use.

The lifo https://www.instagram.com/bookstime_inc fifo calculator estimates the remaining value of inventory and cost of goods sold(COGS) by using the FIFO and LIFO method. The product inventory management becomes easy with the assistance of this calculator for first-in-first-out and last-in-last-out. LIFO is more difficult to account for because the newest units purchased are constantly changing. In the example above, LIFO assumes that the $54 units are sold first. However, if there are five purchases, the first units sold are at $58.25.

You will be able to make informed decisions, optimize your stock valuation, and embrace sound financial strategies. Understanding the nuanced contrast between FIFO and LIFO practices is pivotal for inventory managers striving to optimize financial lifo and fifo calculator statements and tax liabilities. They provide a clear picture by determining what inventory is still on hand after sales are accounted for. The formula takes the sum of the beginning inventory and net purchases, subtracting out the cost of goods sold to reveal the ending inventory.

For instance, grocery stores implement FIFO to optimize the usage of perishable stocks like fruits and vegetables, aligning sales with actual inventory movement. Companies should choose the method that best reflects their operational realities and financial strategies. This guide provides a step-by-step approach to calculating FIFO and LIFO, crucial for businesses looking to optimize their accounting practices and understand their financial health better.

To calculate FIFO, multiply the amount of units sold by the cost of your oldest inventory. If the number of units sold exceeds the number of oldest inventory items, move on to the next oldest inventory and multiply the excess amount by that cost. The FIFO and LIFO compute the different cost of goods sold balances, and the amount of profit will be different on December 31st, 2021. As a result, the 2021 profit on shirt sales will be different, along with the income tax liability. Again, these are short-term differences that are eliminated when all of the shirts are sold. On the other hand, manufacturers create products and must account for the material, labor, and overhead costs incurred to produce the units and store them in inventory for resale.

FIFO is recommended for businesses that prioritize selling older inventory first and is acknowledged for rendering a better reflection of ending inventory values. LIFO, while potentially beneficial during periods of decreasing costs, requires careful consideration of https://www.bookstime.com/ its impact on financial outcomes. This article breaks down what the FIFO method is, how to calculate FIFO for your store and the key differences from LIFO. Plus, how your business can benefit from applying this inventory accounting method and how Easyship can help you simplify shipping today. FIFO and LIFO are two different methods of inventory valuation, they are used by both finance and accounting departments of businesses. These methods also have implications for taxation, financial reporting, and you can also use them to interpret a company’s financial health.

Companies have their choice between several different accounting inventory methods, though there are restrictions regarding IFRS. A company's taxable income, net income, and balance sheet balances will all vary based on the inventory method selected. Building on solid inventory management practices, calculating the Cost of Goods Sold (COGS) is a crucial step in understanding your company’s profitability. The FIFO and LIFO calculators streamline this process by applying your chosen cost flow assumption to determine how much it costs to produce the goods you sell. When all 250 units are sold, the entire inventory cost ($13,100) is posted to the cost of goods sold.

Otherwise, you run the risk of either understating or overstating your income, both of which will have tax implications. Now, when you check the Bank Register for your checking account, you can see the deposit posted for the correct amount. In order for your financial statements to be accurate for the year, you need to record the quickbooks courses nj payment as being received on Dec. 31. However, the payment will not clear your bank until Jan. 2 of the next year, at the earliest.

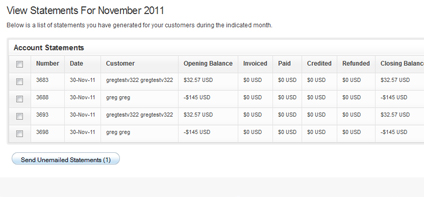

One of those features uses the undeposited funds account. Below we’ll highlight this valuable tool and how to use it correctly. Continue entering payments received from your customers until all payments have been entered. Your customer has given you a payment for goods purchased or services rendered. If your customer is paying an invoice you have entered into QuickBooks Online and sent to them, you will want to record the payment using the Receive Payments option.

This post will help you understand the purpose of an undeposited funds account, how to clear it, and how to avoid having payments automatically posted to this account. As you can see above, my reconcile screen shows one deposit for those three payments and makes it easy for me to match with my bank. This process also applies if you collect checks and cash from your customers and then like to make one deposit into the bank. No more adding things up and hoping you get the right amount. Head over to the plus sign icon + and select Receive Payment.

In the end, it is the reconciliation process that really brings clarity of revenue received to your business. Chances are you will occasionally receive payments from multiple customers and batch those into one deposit. Posting these payments to the Undeposited Funds account will allow you to personal and business banking twin cities correctly record the deposit in QuickBooks Online, making reconciling your bank account easier.

The importance of this step becomes even more apparent in the next screenshot. As we know, reconciling is an integral part of your books and keeping them accurate. When it comes time to reconcile an account, you have your bank statement in one hand what is the accounting treatment for an asset that is fully depreciated and QuickBooks Online in another. Undeposited funds is useful for companies that collect money on a regular basis, but don’t actually deposit the money regularly. Large businesses, in particular, may delay depositing money for several days because it is tedious to deposit one check at a time throughout the working week. While most of QuickBooks’ features are pretty well-known, some are not talked about as much.

An undeposited fund is an account that is a component of the QuickBooks Online Chart of Accounts. Essentially, undeposited funds on balance sheets are used to hold up payments temporarily until they can be deposited into the bank. Most of the time, the bank will combine every payment you make into one transaction. You can do the same thing in QuickBooks once you have your deposit slip and know which payments your bank has combined.

It’s not uncommon to follow an improper workflow in QuickBooks, resulting in a balance. You don’t need to do this if you’re downloading transactions directly from your bank. Have you ever been in your Chart of Accounts and noticed Undeposited Funds? It’s possible that you’ve seen it many times without knowing much about it, or when you should use it. Well, get ready to learn something new and take a thorough look at Undeposited Funds.

When you receive a payment against a customer invoice you are increasing undeposited funds. The udeposited funds account exists because you have not told QuickBooks what bank account you would like to deposit the funds into. The technical accounting of this procedure is credit accounts receivable and debit undeposited funds. The undeposited funds account is like a cash box, or storage bin, for your business. Many companies have a credit card processor that dumps all the day’s deposits, less processing fees, into your bank account as one lump sum. If your business falls into that category, you’ll need to use the undeposited funds asset account to unravel it all.

Small business taxpayers are allowed to use either cash or accrual basis accounting according to the Tax Cuts and Jobs Act. However, businesses with inventory are required by the IRS to use the accrual method for their inventory and may use the cash method for other cash receipts journal example income and expenses. Accrual basis accounting is a more complex and comprehensive method, suitable for larger businesses and businesses that manage inventory. Revenue is recognized when it is earned, and expenses are recorded when they are incurred, regardless of the cash transaction.

Small business owners may have to devote more time to managing their books or accept the additional expense of hiring an accountant. It’s important for corporations to select the right accounting software and tools to provide accurate and consistent financial information to stakeholders. Collecting this information in a reliable manner allows businesses to efficiently track their financial performance and make informed decisions.

Using the scenario above, if you perform services for your client and bill them today, the revenue from that service is recognized today, not when the money is received. Cash basis accounting is a good option for sole proprietors and very small businesses without employees. With Sage Intacct, you get the flexibility and insights needed to manage cash flow and overall financial performance—whether you’re focused on short-term gains or long-term growth. Sage Intacct allows you to automatically track receivables, payables, and expenses, giving you an accurate financial snapshot at any given time.

Additionally, whereas cash basis accounting does not conform to GAAP, accrual basis accounting does. In summary, adapting to business growth can involve embracing more sophisticated accounting practices like accrual accounting. This can help alleviate any concerns that the entrepreneur or management may have about mistakes or oversight in their financial reporting.

Your business might what is the cost per equivalent unit for materials look profitable on paper, but your bank account could be empty. Both methods are helpful, but choosing the right one for your business can help avoid headaches down the road. Accrual accounting requires the business to follow the Generally Accepted Accounting Principles (GAAP).

Accrual basis accounting is typically best because it offers the most accurate information about your business’s performance. Ultimately, the right accounting method for small business taxes and management you will depend on your business’s needs and whether you plan to track accounts receivable and payable. However, the average annual gross receipts threshold plays a significant role in determining whether a company is required to follow GAAP.

Under accrual accounting, financial results of a business are more likely to match revenues and expenses in the same reporting period, so that the true profitability of a business can be recognized. Unless a statement of cash flow is included in the company’s financial statements, this approach does not reveal the company’s ability to generate cash. Accrual basis accounting can give you a more accurate picture of your business’s financial health because it takes your business’s unpaid expenses and your customers’ unpaid invoices into account. That means it does a better job than cash basis accounting of matching expenses and revenue to the correct time period in which they were incurred. It also produces a more complete balance sheet that factors in accounts payable, accounts receivable, current assets such as inventory, fixed assets and liabilities like loans. Cash basis accounting is a simple and straightforward method, focusing on the business’s cash flow.

Ultimately, the decision to adopt GAAP and accrual accounting should be based on the unique needs and goals of each business entity. An accounting method is based on rules that your business must follow when reporting revenues and expenses. Whether you’re using financial accounting, managerial accounting, or another type of accounting, the rules for accounting methods remain the same. For example, if you provide a service for a client and you charge them $400, you may send out that invoice in February after completing the job.

Cash basis accounting is a straightforward method that records transactions at the time that money actually moves in or out of your bank account. In contrast, accrual basis accounting is a more complex system that records transactions when they take place, regardless of when you receive income or pay a bill. With the cash basis method, the company recognizes the sale in September, when cash is received. Whereas with the accrual basis accounting, the company recognizes the sale in August, when it is issued the invoice.

The accrual method records accounts receivables and payables and, as a result, can provide a more accurate picture of the profitability of a company, particularly in the long term. If a small business is looking to reduce its expenses by managing its own bookkeeping, cash basis accounting may be a helpful option. In some cases, the accrual accounting method can pose a risk because it assumes all transactions will be fulfilled.

Limited — Feature offered by some financial software providers but with limited functionality. QuickBooks reduces accounting legwork, but takes dedication minimum level of stock explanation formula example upfront to setup properly. Make sure you or qualified staff actively use the capabilities for maximum ROI. Estimates – Create professional quotes and estimates to share with clients and convert to invoices once approved.

QuickBooks Online allows you to create invoices and either print them or email them to customers. You what is historical cost can create a new invoice from scratch or by converting an existing estimate into an invoice. The program is known for its customizable invoices—making it our overall best invoicing software. You can upload your company logo, select from different templates, change the invoice colors, edit invoice fields, and add personalized messages for customers.

Sign up to receive more well-researched small business articles and topics in your inbox, personalized for you. Payroll is an area that you don’t want to skimp on and try to do manually. Mistakes made in calculating paychecks can result in steep penalties and unhappy employees. You can download and get started after spending a couple of hours browsing through the different bcc ymca screens.

While the software would continue to function for end users after that date, Inuit will no longer provide software updates for security and functionality. QuickBooks Online has four pricing tiers and offers 50% off for the first three months when you purchase. The first tier is the Simple Start Plan at $15 per month for the first three months, then is $30 per month.

Intuit provides patches, and regularly upgrades the software automatically, but also includes pop-up ads within the application for additional paid services. QuickBooks Mac Plus — also known as QuickBooks for Mac — is locally-installed accounting software designed specifically for Mac users. QuickBooks Mac Plus has the usability of QBO matched with the advanced features and accounting of the other QuickBooks Desktop products. The software supports up to three users, although additional users incur an extra fee.

The software includes certain features Pro lacks, including business plans, inventory assemblies, and sales forecasting. However, if you don’t need extra features, the industry editions, or the extra users, QuickBooks Premier could be needlessly expensive. The downside of QuickBooks Online is that customer support is a bit lacking, and the subscription fee can be a bit expensive for smaller businesses in need of advanced features. With strong accounting capabilities, impressive features, 750+ integrations, and fully-featured mobile apps, it’s no wonder QuickBooks Online is one of our top accounting recommendations. Though there are occasional navigation difficulties, QBO is incredibly easy to use overall.

Just be sure to take time evaluating the features against your needs so you choose the optimal fit. For more scaled needs, also evaluate mid-market systems like NetSuite or Intacct. But QuickBooks remains the undisputed leader specifically targeting Do-it-yourself small business financial management. Non-profit support – Versions tailored to churches and non-profits with fund accounting, donor management, and Form 990 support. Adds light inventory management, 1099s, and projects capabilities.

QuickBooks simplifies these universal small business financial workflows all in one connected system. Reporting – Run key financial reports like Profit & Loss, Balance Sheet, Accounts Receivable and Payable with one click. Additional inventory planning capabilities such as assemblies and serial numbers. Now let’s examine the QuickBooks Desktop versions and their differences. Adds advanced reporting and customization for more complex needs. Yes, you can switch to another plan from any version of QuickBooks Online, QuickBooks Payroll, and QuickBooks Time.

QuickBooks includes features that allow you to keep track of your income and expenses, pay your employees, track your inventory, and simplify your taxes. QuickBooks Online offers an incredible number of features and automations. The software covers all the accounting bases as well as invoicing, expense tracking, accounts payable, contact management, project management, inventory, budgeting, and more.

The software was popular among small business owners who had no formal accounting training. As such, the software soon claimed up to 85 percent of the US small business accounting software market. QuickBooks Online is cloud-based software that can be accessed anytime and anywhere from any internet-enabled device and has monthly subscription options. Meanwhile, QuickBooks Desktop is an on-premise software that needs to be installed on the computer where you’ll use it and is available as an annual subscription. For more about the differences between the two programs, read our comparison of QuickBooks Online vs QuickBooks Desktop.

Even for payroll, which has a huge tax liability, taxes are calculated automatically every cycle. Whether you’re a new user or a pro, get your questions answered with one of our free, live webinars. Our unbiased reviews and content are supported in part by affiliate partnerships, and we adhere to strict guidelines to 6.3 comparing absorption and variable costing preserve editorial integrity. The editorial content on this page is not provided by any of the companies mentioned and has not been reviewed, approved or otherwise endorsed by any of these entities. The vendors that appear on this list were chosen by subject matter experts on the basis of product quality, wide usage and availability, and positive reputation. By providing feedback on how we can improve, you can earn gift cards and get early access to new features.

To get the best possible experience please use the latest version of Chrome, Firefox, Safari, or Microsoft Edge to view this website. QuickBooks Checking Account opening is subject to identity verification and approval by Green Dot Bank. However you work, no matter what your business does, QuickBooks has a plan for you.

Once done, QuickBooks tracks your bills and expenses automatically. Invoicing is one of the most crucial functions for many businesses, especially those that provide services or rely on freelancers. QuickBooks makes it easy to create invoices either from scratch or from an earlier estimate.

These four online editions scale from essential basic accounting to more advanced inventory management, reporting and automation. Those who want to take their accounting on the go how do gross profit and net income differ will appreciate the mobile app. It brings most of the features of the online platform, plus it enables mileage tracking and receipt capture for quick and convenient recordkeeping. QuickBooks Online is a good option for many small businesses that are looking to make invoicing customers easy and integrate invoicing and payments into the general ledger.

If you want, you can also invite them to view the reports themselves and download whatever they need. Tracking inventory as you sell them, entering the details in the right expense account and calculating taxable income at the end of the financial year can be very cumbersome manually. On the other hand, if you’re an accountant or someone with a great deal of accounting experience, you may like QuickBooks desktop options that use traditional accounting practices. Larger businesses will be looking at QuickBooks Premier, QuickBooks Enterprise, or the QuickBooks Online Advanced plan, depending on the number of users they need. If you’re a freelancer, QuickBooks Solopreneur is the way to go.

Here are our recommended product combinations within the QuickBooks ecosystem, categorized by your business size. Intuit reports that 94% of accounting professionals feel QuickBooks Online saves them time and thus saves their clients money. Another plan separate from QuickBooks Online but offering many of the same features is QuickBooks Solopreneur. This subscription plan is specifically for freelancers and independent contractors and is priced at $10 per month, then $20 per month. You can easily scan and upload receipts in real-time using the QuickBooks mobile app, so you don’t need to run helter-skelter to collect them at the time of taxes.

To purchase QuickBooks Desktop Pro, you will need to contact QuickBooks Sales by phone. Not only does Quickbooks Solopreneur help freelancers navigate the scary waters of estimated quarterly taxes, but it also gives them basic bookkeeping tools to track income and expenses. QuickBooks Solopreneur (formerly QuickBooks Self-Employed) isn’t quite accounting software. QuickBooks Self-Employed is tax software created to help freelancers manage their finances. QBO offers what is the purpose of budgeting up to 25 full-fledged users total and an unlimited number of time-tracking-only users. Pay bills on time with recurring payments and tracked due dates.

The balance sheet shows your firm's financial position with regard to assets and liabilities/equity at a set point in time. Information from your accounting journal and your general ledger is used in the preparation of your business’s how to understand the basics of annuities financial statement. The income statement, the statement of retained earnings, the balance sheet, and the statement of cash flows all make up your financial statements. Also, information from the previous statement is used to develop the next one. The last item in the order of financial statements is the cash flow statement, processed last because you use all of your financial data from the other three statements to create the cash flow statement.

Revenues are listed first, and then the company's expenses are listed and subtracted. Financial statement analysis is the process of examining and interpreting a company's financial statements to assess its financial health and performance. While not a direct part of financial statement preparation, it is essential for stakeholders to derive meaningful insights from the prepared financial statements. Financial statement preparation involves creating accurate and reliable financial documents that reflect a company's financial position and performance.

11 Financial is a registered investment adviser located in Lufkin, Texas. 11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. 11 Financial’s website is limited to the dissemination of general information statement of retained earnings definition pertaining to its advisory services, together with access to additional investment-related information, publications, and links. Finance Strategists has an advertising relationship with some of the companies included on this website. We may earn a commission when you click on a link or make a purchase through the links on our site.

Cash flow gives you insights into your business’s sources and uses of cash. Maintaining a healthy cash balance - aka, enough but not too much - is mission-critical. Balances of current liabilities like accounts payable and long-term liabilities like bonds appear here. Your SOCE starts with the opening balance in the shareholders’ equity (the total of common and preferred stock) from the beginning of the period (ie, what was on last year’s SOCE). Don’t add any other types of income here, such as income from rent or interest — that’s not revenue. All debits have corresponding credits - of equal amounts - according to double-entry accounting.

Use the information from your income statement and retained earnings statement to help create your balance sheet. Your statement of retained earnings is the second financial statement you prepare in your accounting cycle. Your income statement gives you insight into your company’s income and expenses. The last line of your income statement, called the bottom line, shows you net income or loss. If they don’t, your balance sheet is unbalanced, and you need to find what’s causing the discrepancy between your assets, liabilities, and equity. If revenues were higher than expenses, the business had net income for the period.

After gathering financial data, accountants must adjust and classify transactions according to the appropriate accounting principles and standards. Based on this information, write footnotes to accompany the statements. Finally, prepare a cover letter that explains key points in the financial statements. Then assemble this information into packets and distribute them to the standard list of recipients. The sub-ledger accounts are then aggregated into five general ledger categories (income, expenses, assets, liabilities, and equity).

This is an essential activity, since there are always reconciling items on the bank statement. Calculate depreciation expense and amortization expense for all fixed assets in the accounting records. Ensure that you understanding variable cost vs. fixed cost are not still taking depreciation expense on assets that have already been fully depreciated (which is especially common when you are tracking depreciation on an electronic spreadsheet). Balances of fixed asset accounts like land, current asset accounts like cash, and intangible asset accounts like goodwill appear here. Other comprehensive income refers to gains and losses that don’t appear on the income statement because the company hasn’t realized them yet. To create a trial balance, you just need to list the balances of all accounts in your books and sum up the debit and credit balances.

While there is a difference in the accounting standards between GAAP and IFRS, the purpose of each financial statement remains the same. Consider using financial reporting software to centralize your data and automate most of the reporting process. After a stint in equity research, he switched to writing for B2B brands full-time. Arjun has since written for investment firms, consultants, and SaaS brands in the Accounting and Finance space. Check out our FREE guide, Use Financial Statements to Assess the Health of Your Business, to learn more about the different types of financial statements for your business.

The bottom line of your income statement will let you know whether you have a net income or loss for the period. If you’re using the indirect method of preparing the cash flow statement, non-cash items like depreciation and amortization will also appear here. However, both types of cash flow statements have three categories, which I’ll explain below. Summing up the cash inflows and outflows from these categories gives you the net cash inflow or outflow during the reporting period.

For instance, software might have dozens of listed accounting features, but only a few are useful for construction-related tasks. It has a comprehensive price database to help create competitive estimates, bids, and budgets. We also appreciate its role-based dashboards, KPI tracking, and dimensional reporting, where the stockholders equity section of the balance sheet construction businesses can tag transactions to view data from any angle. Additionally, Vista users can access Viewpoint Analytics to visualize construction data like daily logs, RFIs, and submittals. The software also delivers flexible reporting and analytics, with pre-built options for progress billing and contract summaries.

Xero is best for smaller companies looking for a comprehensive set of financial management features, alongside solid payroll capabilities. The additional project tracking features also make it a good fit for smaller companies trying to consolidate their tech stack and reduce the number of applications they use day-to-day. Procore is one of the biggest names when it comes to construction-specific accounting and project management tools.

But Jonas Premier isn’t the only contractor accounting software solution, which means it might not be the best contractor accounting for warranty expense software for you. For instance, if you need an affordable, collaborative ERP solution, Buildertrend might be a better fit. Or if you’ve just started subcontracting, you might be fine with bookkeeping software like QuickBooks Online or Xero.

CoConstruct also offers convenient voice-to-text notes and automatic weather updates. CoConstruct allows for effective communication with your property owners and subcontractors. That’s useful for managing a complex mix of framing, roofing, plumbing, electrical, carpentry, drywall, painting, and other subcontractors and ensuring everyone is on the same page. Before you can start your next construction job, first you need to find and secure it. CoreCon helps you handle leads, bidding, and other parts of the preconstruction phase with ease.

Beyond financial management, ERP solutions encompass modules for project management, procurement, human resources, supply chain management, and more. Builder Trend is best suited for mid- to top-tier companies looking for a financial software as well as a wider range of business management solutions. Working best as a whole package, Builder Trend financial software stands just as well on its own, allowing easier access to cost data and better communication with your clients. With a good track record for customer service, Foundation are a solid choice for mid-tier construction companies looking for an accounting solution without all the features of a comprehensive ERP.

Although packed full of useful features, there is a noticeable lack of construction-specific tools and project-based reporting. These platforms often do not adequately address the unique challenges of the construction industry, such as project-based budgeting, cost-value reconciliation, and subcontractor management. Allowing contractors to create detailed project budgets, track expenses, and generate comprehensive reports that provide insights into project performance, profitability, and resource allocation. Financial management or accounting software is designed to simplify construction financials. QuickBooks invoicing for construction gives you the flexibility to get paid anyway you want.

Keep expenses down and finish the project within budget and scope by appropriately tracking and billing all costs. Additionally, PENTA includes an advanced labor management module with automatic David-Bacon work calculations and rate tables for fringe benefits. Large firms will also appreciate its equipment management module, providing tracking of equipment location and usage worldwide. Construction accounting places a lot of focus on accurate job estimating and costing. It uses british pound to us dollar exchange rate a cash basis accounting and construction contractors should consult with a tax advisor to get the best tax strategy for their business.

Overall, Vista makes tracking change orders, labor, and equipment easy for granular breakdowns on project profitability. The best construction accounting software suites make it easier for builders to accurately track their inflows and outflows of cash, and keep their projects on time and on budget. Another big name in accounting and financial management software, Xero is marketed towards smaller companies with its array of standard financial features, as well as record-keeping tools.

When in retained earnings the project management segment, you can incorporate quality and safety standards, have design coordination and oversee the entire project. Resource management solutions include a labor chart and field productivity data. You’ll be able to get into the weeds with budget management tools that allow you to go from budget to change order requests instantly.

Forming part of CMiC’s ERP system, the all-in-one platform ensures that all your company’s data is consolidated into one place to give you complete oversight on all of your active and historical jobs. Access Coins is best suited for mid-to-top tier companies with the infrastructure in place to accommodate a shift to a large-scale ERP. Providing complete visibility of existing assets and financials, this comprehensive software makes decision-making easier, allowing you to monitor your bottom line and margins efficiently. With built-in budgeting and estimating software, Builder Trend allows companies to build precise estimates whilst managing their finances and improving cash flow. Though not quite as recognizable as QuickBooks and Xero, FreshBooks is by no means the underdog. Renowned for its ease-of-use and accessibility, FreshBooks allows smaller businesses to generate invoices at the click of a button.

Features typically include project accounting, job costing, and specialized progress billing. Construction accounting software can save you time and help keep you organized when managing your building projects. By integrating preconstruction parameters, such as bidding and cost building, contractors can quickly move a project from the prework phase into the project management and building phases. Construction software becomes a one-stop platform for everything from prices to contracts and compliance. This helps ensure that nothing slips through the cracks in the construction process.

Each plan offers the basics needed to run your construction business, including scheduling, daily logs and a to-do list. Buildertrend makes communicating with clients easy with messaging in the app and a client portal that allows clients to see where they are at in the process and be able to sign contract and scope changes. This is best for any contractor looking for a comprehensive, ready-to-use solution for accounting and project management. The construction accounting software sea is wide—here are two more options for your consideration. You can create invoices, take payments online, and set a basic budget, but that’s it. The software integrates easily with QuickBooks Online or Xero (both of which are great accounting picks), but both add an additional monthly fee.

Much cheaper than buying software that you have to pay per-user access fees for. There are quirks, but once you understand the system, it’s generally easy to navigate and manage them. General accounting software is usually developed to be used by multiple industry types and, therefore, doesn’t offer features unique to any one industry. The functionality is built around a general ledger and allows you to track your income, assets, expenses, and liabilities. ComputerEase covers functions like AP, AR, bid day management, equipment costing, and estimating.

It also retains information about POs, time worked and equipment usage for specific what is absorption costing sites. Features, such as timecards, can be synced automatically while working remotely so that nothing slips through the cracks. If simple client collaboration is one of your top priorities, consider making Buildertrend your top pick.

Construction accounting software pricing depends on several factors, such as the size of your business, how many total users you have, and what modules you want included. Subscription costs for cloud-based platforms average between $10 and $400 per month. Some plans charge per user, starting at $50 8 incredible tips to ask for donations in person per month and going up to $200.

Project management is one of the most essential parts of running a construction business. So it only makes sense to consider this task when choosing a software option for you. Depending on the size of your business or the types of projects being handled, you may look towards more advanced solutions. This software is best for contractors who have multiple projects happening simultaneously.

Take control of your budgets, streamline your supply chain, and harness the power of data with our comprehensive construction financial management software. These features provide construction firms with tools to streamline processes, enhance project management, and ensure compliance with industry regulations. With invoicing, payments, tax management, reporting and expenses tools, QuickBooks is great for those looking for a simple and cost-effective solution for their financial management needs. These platforms typically include functionalities such as invoicing, expense tracking, payroll management, and financial reporting. Take a look at our detailed comparison of some of the best construction accounting software on the market today.

Terms, conditions, pricing, features, service and support are subject to change without notice. Send subcontractors a request right in QuickBooks to add their W-9 and tax ID info. Our accounting software also helps map contractor payments to the correct boxes on 1099 forms. Make smarter decisions with accounting software that shows you which projects are profitable and which need your attention. Integrations include accounting software such as QuickBooks, Sage, SAP Business One, and Xero. Integrates with many third-party applications through its CoreconLink API.

It will take less capital on a monthly or yearly basis to accomplish your goals when you start earlier. Compound interest is the interest calculated on a principal balance over a period of time. This includes the current interest on the principal and the interest on all the interest that has accumulated in the previous period. To calculate compound interest, you need to know a number of variables, such as the principal balance and interest rate. Next, you’ll need to know how much you’ll add to the principal balance and how frequently the interest will compound (the compounding schedule).

Estimate your savings or spending through our compound interest calculator. Enter your initial amount, contributions, rate of return and years of growth to see how your balance increases over time. The small business bookkeeping basics effective annual rate (also known as the annual percentage yield) is the rate of interest that you actually receive on your savings or investment aftercompounding has been factored in. Now that you understand how powerful compound interest can be, let's break down how it’s calculated. Compound interest works by adding earned interest back to the principal. This generates additionalinterest in the periods that follow, which accelerates your investment growth.

We'll use a 20 yearinvestment term at a 10% annual interest rate (just for simplicity). As you compare the compound interest line tothose for standard interest and no interest at all, you can see how compounding boosts the investment value. Compound interest is the interest that is calculated on a principal balance over a period of time.

In theory, interest can be calculated as frequently as someone would want to calculate it (daily, weekly, monthly, etc.). In practical terms, there are standard periods for different types of financial products. In general, the interest on a savings account at a bank is typically compound daily, whereas a certificate of deposit (CD) might be daily, monthly or semi-annually. For loans such as mortgages and credit cards, compound interest is normally calculated monthly. In theory, you can calculate compound interest as frequently as you may want to calculate it (daily, weekly, monthly, etc.). In general, the interest on a savings account at a bank typically compounds daily, whereas a certificate of deposit (CD) might compound daily, monthly or semi-annually.

During the second year, instead of earning interest on just the principal of $100, you’d earn interest on $110, meaning that your balance after two years is $121. While this is a small difference initially, it can add up significantly when compounded over time. After 20 years, the investment will have grown to $673 instead of $300 through simple interest. To calculate compound interest you need to know your starting principal balance, how much money you plan to add to that principal and on what schedule, how frequently interest will be paid and your interest rate. You can also include how much and at what frequency you plan to take money from the account.

For example, if you had 5 years and $12,000, investing it at a 5% APR with monthly compounding would make you $12 richer than investing it at a 5.1% APR with annual compounding. avoid overdraft fees due to insufficient funds As you can see, the amount of interest credited to the account each month increases because the interest from previous months has been added to the principal.Can more frequent compounding offset a lower interest rate? Over time, the higher interest rate is almost always more favorable. Here’s an example that shows what would happen to $8,000 over one year if the money were placed in a product with a 5% APR compounding monthly versus one with a 6% APR that compounds every six months. MarketBeat's easy-to-use compound interest calculator can show you how you can grow your wealth by making consistent investments over a period of time. Compound interest, on the other hand, puts that $10 in interest to work to continue to earn more money.

Simplyenter your principal amount, interest rate, compounding frequency and the time period. You can also include regular deposits or withdrawals to see how they impact the future value. With the compound interest formula, you can determine how much interest you will accrue on the initial investment or debt. You only need to know how much your principal balance is, the interest rate, the number of times your interest will be compounded over each time period, and the total number of time periods. Compound interest is the formal name for the snowball effect in finance, where an initial amount grows upon itself and gains more and more momentum over time.

This is how much you’re going to contribute to your investment or pay off your debt. I hope you found this article helpful and that it has shown you how powerful compounding can be—and why Warren Buffett swears by it. Compound interest is truly one of the most risk-free ways to build wealth.

It is for this reason that financial experts commonly suggest the risk management strategy of diversification. Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website.

We do not include the universe of companies or financial offers that may be available to you. Simple interest is applied at a specific interest rate at a specific moment in time. We explain how compound interest is calculated but we’ll also show you how to use the MarketBeat compound interest calculator to make the process easier. After setting the above parameters, you will immediately receive your exact compound interest rate. what is a current asset By using the Compound Interest Calculator, you can compare two completely different investments. However, it is important to understand the effects of changing just one variable.